6 Key Reasons Your Business Should Lease Golf Carts and Utility Vehicles

The decision to lease or buy equipment is significant in the business world. While the appeal of owning your equipment is often strong, leasing can free up significant capital for small business owners. This is particularly true for organizations utilizing golf carts and utility vehicles, subsequently referred to as Small Task-Oriented Vehicles(STOVs) - in their daily operations, such as universities, car dealerships, security companies, apartment complexes, and construction companies.

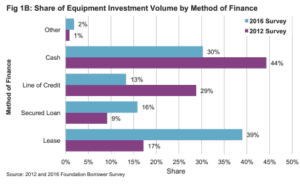

According to a U.S. Equipment Finance Market Study for 2016, 39% of businesses surveyed who acquired new equipment opted to lease rather than buy. This is up from 17% in 2012. This trend shows that companies increasingly turn to equipment leasing to free up cash for other financial needs.

How Do Equipment Leases Work?

Types of Leases: There are two main types of equipment leases: Capital Leases and Operating Leases.

Operating Lease:

An operating lease is also known as a Fair Market Value Lease. These are more like short-term rentals, allowing a company access to equipment for a shorter term with a set period, payment, interest rate, and residual value. You may choose to buy the vehicle at the end of the lease or turn it in for new equipment on renewal. This provides a lot of flexibility and improved cash flow. Additionally, the lessee can often cancel the lease with prior notice and return the vehicle before the term ends.

Capital Lease:

This type of lease is more similar to a loan. They are typically long-term and cannot be canceled by the lessee.

At the end of the lease term, the lessee purchases the vehicle for $1. This type of lease is commonly used for golf carts and UTV procurement, especially when a business plans to keep the vehicle for a long period of time.

Here are some key points about $1 buyout leases:

- They are used for equipment that retains its value over time, including golf carts and utility vehicles.

- They have a pre-set lease term with fixed monthly payments.

- Equipment ownership is often transferred to the lessee, so the equipment appears on the balance sheet as company assets.

- At the end of the lease term, the lessee purchases the equipment for $1.

The Benefits of Leasing

1. Lower Upfront Costs:

Leasing STOVs costs you just the first lease payment and additional fees to get the equipment you need for your business. If you choose to buy, this is significantly less than the full cost or down payment required for regular commercial equipment financing. Even if you have enough money to buy the equipment, leasing allows you to hang on to that cash and keep it ready for other uses or needs in your business.

With equipment leasing, you pay a fixed rate over a specific period. The interest and fees are built into the payment. This allows you to spread the cost over the vehicle usage period as an operating expense.

2. Flexibility:

Leasing provides flexibility that buying does not. Many leases will allow companies to return or buy out the equipment at the lease's conclusion. This flexibility is particularly beneficial for businesses in industries that change rapidly, making current equipment obsolete every few years.

Leasing is also a great option if your business plans to use the equipment for a predetermined amount of time. For example, if you're a construction company and need equipment just for the duration of a particular job, a lease may work better for your business.

3. Avoiding Obsolescence:

Lease terms vary from 6 months to 5 years, depending on the originator. At the end of the term, you can return the equipment to the lessor, allowing you to upgrade to new equipment or return it altogether. This reduces the chance that your company gets stuck with obsolete equipment.

4. Maintenance Costs:

Sometimes, when bundling an equipment lease with a service contract, this can make your operating expenses more predictable than if you purchased the equipment outright. Click here to learn about the commercial fleet services that ACE of Carts offers.

5. Tax Breaks:

Companies typically can deduct the entire cost of the lease payment as an operating expense, compared to just the interest paid when purchasing a vehicle. This provides an income tax break because you can deduct your leasing costs as a business expense.

6. Easier Access to Equipment:

Leasing offers an easier way to get the necessary equipment if your company’s credit is questionable. This is because leasing companies look at various factors when evaluating a machinery leasing application, including the length of time in business, credit scores, and cash flow and profitability.

The Drawbacks of Leasing

While leasing has many advantages, it also has some potential disadvantages. These include:

- Potentially higher overall costs, depending on the length of the lease’s term. Leasing requires that you pay interest, which adds to the overall cost of the machine over time. Sometimes, leasing can be more expensive than purchasing the equipment outright, especially if you purchase the equipment when the lease term has expired.

- Continued payment for obsolete equipment – and even equipment you no longer use – if your lease doesn’t include upgrades and your term hasn’t ended.

- The inability to consider leased equipment an asset is a disadvantage if you need collateral to qualify for a loan.

Final Thoughts:

When deciding between leasing or buying, consider the equipment you need, how long you plan on using it, and your company's financial position. If you’re short on cash and will only use the equipment for a short time, leasing equipment has many advantages. On the other hand, if you’re in a strong cash position and plan on using the equipment for a long time, buying the equipment might be more cost-effective than leasing.

Ultimately, the decision to lease or buy equipment significantly depends on your business needs and financial situation. It's always a good idea to consult with your accountant to understand the full financial implications of your decision.

Additional Reading: